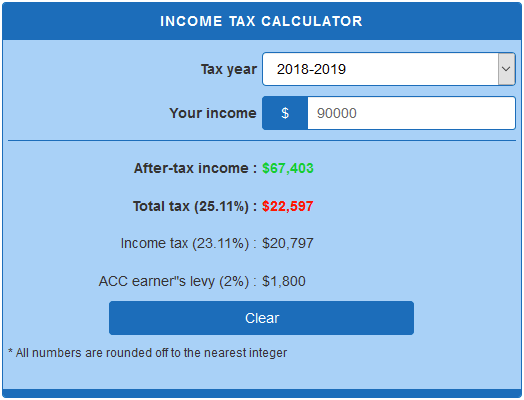

Quick tax return calculator

It compares the taxes a married couple would pay filing a joint return with what they would pay if they were not married and each filed as. Gross Expenses F1040 L23-35.

Tax Estimator Best Sale 56 Off Ilikepinga Com

If you earn more than 2700000 per year your Income Tax deducted is calculated in two 2 parts.

. Estimate your tax refund with HR Blocks free income tax calculator. Gross Income F1040 L7-21 Please Enter your Gross income. Tax2win is the reliable source to e-File Income Tax Return for FY 2021-22 AY 2022-23.

Nearly 70 of filers take it because it makes the tax-prep process quick and easy. Tax Filing Fast and Easy. You can quickly estimate your Arizona State Tax and Federal Tax by selecting the tax year your filing status Gross Income and Gross Expenses this is a great way to compare salaries in Arizona and for quickly estimating your tax commitments in 2022.

Looking for a quick snapshot tax illustration and example of how to calculate your tax return. Certain types of income most notably capital gains are taxed as regular. The new tax regime offers lower tax rates as compared to the old tax regime.

Federal Income Tax Return Calculator. However as per Taxation and Other Laws Ordinance 2020 any delay in payment of tax which is due for payment from 20-03-2020 to 29-06-2020 shall attract interest at the lower rate of 075 for every month or part thereof if same is paid after the due date but on or before 30-06-2020. The above calculator provides for interest calculation as per Income-tax Act.

Click the Customize button above to learn more. Just get started and. Illinois State Tax Quick Facts.

DisclaimerThe above calculator is only to enable public to have a quick and an easy access to basic tax calculation and does not purport to give correct tax calculation in all circumstances. Use tool Estate Tax Liability. Its never been easier to calculate how much you may get back or owe with our tax estimator tool.

For the tax calculators below be sure to have your 1099 or W-2 form handy and be ready to answer a few basic questions about your filing status income deductions and credits. DisclaimerThe above calculator is only to enable public to have a quick and an easy access to basic tax calculation and does not purport to give correct tax calculation in all circumstances. This calculator lets you create specific situations to see how much federal income tax two people might pay if they were to marry.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. The last date of filing belated ITR is December. File ITR for income from Salary Interest Business Capital Gains House Property utilize Deductions under 80C 80D 80CCF 80G 80E 80U etc.

For claiming a refund one has to file the income tax return within a specified period. Colorado Tax Calculator - Quick Tax Estimator. If you want to customize the colors size and more to better fit your site then pricing starts at just 2999 for a one time purchase.

Use tool Earned Income Tax Credit Estimator. 2020 Tax Calculator Planner for 2021 filing. 13 of the gross amount needs to be calculated as your Non-Taxable Income then the following deductions are made.

People and businesses with other income including COVID-19 grants and support payments must report it in a tax return. However an individual is required to pay a late filing fee if heshe is filing belated ITR. If you have missed the deadline of filing income tax return ITR for FY 2021-22 ie July 31 2022 then an individual has an option to file the belated ITR.

Your household income location filing status and number of personal exemptions. This 6k after tax salary example includes Federal and State Tax table information based on the 2022 Tax Tables and uses Ohio State Tax tables for 2022The 6k after tax calculation includes certain defaults to provide a standard tax calculation for example the State of Ohio is used for calculating state. Under both the income tax regimes tax rebate of up to Rs 12500 is available to an individual taxpayer under section 87A of the Income-tax Act 1961.

Your household income location filing status and number of personal exemptions. This federal tax calculator is as good as the feedback your support requests and bug catches help to. You dont pay any dividend tax on the first 2000 you make in dividends.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. How to calculate your tax refund. Before the deductions are made.

1040 Federal Income Tax Estimator. Return Status Check E-file Status Track IRS Refund Tax Tools Tax. Please Enter your Gross income.

You pay 75 on the next 1000. Your 1040 tax return in Excel format. Call HMRC on 0300 200 3300 so they can change your tax code youll pay the dividend tax through your salary or pension.

Information relates to the law prevailing in the year of publication as indicated Viewers are advised to ascertain the correct positionprevailing law before relying upon any document. If you need to send a Self Assessment tax return fill it in after the end. However under Sections 237 and 1192b of the Income Tax Act the Chief Commissioner or Commissioner of Income Tax are empowered to condone a delay in the claim of a refund.

I have found it extremely useful and would definitely recommend you to my friends. It is advised that for filing of returns the exact calculation may be made as per the provisions contained in the relevant Acts Rules etc. Use our quick tax calculator to find out your marginal tax rate and additional tax savings due to RRSP contribution.

Just wanted to send a quick note to say how fab your spreadsheet is. A simple tax return excludes self-employment income Schedule C capital gains and losses Schedule D rental and royalty income Schedule E. Choose a different State.

To estimate your tax return for 202223 please select the 2022 tax year. If you normally file a. If one finishes working prior to the year end or for joint assessment of.

No Need to visit our office. Virginia State Tax Quick Facts. The quick ratio calculator exactly as you see it above is 100 free for you to use.

To estimate your tax return for 202223 please select the 2022 tax year. Get your 2021 tax refund in 10 days by filing your income tax return directly with the CRA or Revenue Quebec using our NETFILE certified program. H and R block Skip to.

US Tax Calculator and alter the settings to match your tax return in 2022. Go to our Salary Tax Illustrations and select an annual salary assessment for an instant tax illustration with tax breakdown and Medicare example. Just answer a few simple questions about your life income and expenses and our free tax calculator will give you an idea if you should expect a refund and how much or if youll owe the IRS when you file taxes in 2021.

Basic Info Progress Indicator. You could claim a credit of 50 on your income tax return which.

Tax Return Calc Deals 55 Off Www Wtashows Com

Self Employed Tax Calculator Business Tax Self Employment Employment

Sales Tax Calculator Taxjar

How To Calculate Taxable Income H R Block

Tax Year 2022 Calculator Estimate Your Refund And Taxes

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Taxable Income Formula Examples How To Calculate Taxable Income

When Are Taxes Due In 2022 Forbes Advisor

Best Tax Software Of September 2022 Forbes Advisor

Tax Return Calculator How Much Will You Get Back In Taxes Tips

Do I Need To File A Tax Return Forbes Advisor

Tax Year 2022 Calculator Estimate Your Refund And Taxes

Tax Return Calculator How Much Will You Get Back In Taxes Tips

Taxable Income Formula Examples How To Calculate Taxable Income

Excel Formula Income Tax Bracket Calculation Exceljet

Excel Formula Basic Tax Rate Calculation With Vlookup Exceljet

Corporate Tax Calculator Template Excel Templates Excel Templates Business Tax Business Structure